Why Insurance Providers Should Embrace Recurring Payment Models for Long-Term Success

March 21, 2025

As the digital economy continues to evolve, insurance providers are looking for new ways to stay competitive, boost revenue, and enhance customer satisfaction. With nearly 63% of insurers planning to fully digitize their operations by 2025, the industry is undergoing a major transformation. One of the most effective strategies for staying ahead is adopting recurring payment models. Below, we explain why insurance providers should embrace recurring payment models for long-term success.

- Transform Policyholders into Engaged Subscribers

Traditionally, insurance has been perceived as a one-off transaction—customers pay their premiums and move on. However, recurring payment enables insurance providers to reframe the customer relationship as a subscription model, delivering continuous value over time. By transitioning to a recurring payment structure, insurance companies can redefine policyholders as subscribers, cultivating long-term loyalty rather than focusing solely on one-time payments. A recent study has shown that implementing recurring payment systems can drive customer retention rates up to 20% higher compared to non-recurring models.

- Drive Operational Efficiency with Payment Integration

Manual payment processing is often a time-consuming, leading to unnecessary administrative burdens. Integrating recurring payment into insurance systems eliminates these challenges, optimizing operations and minimizing the need for manual involvement. Automating payment collection and seamlessly integrating it with existing platforms enables insurers to minimize human error and prevent costly mistakes. This integration allows staff to shift focus toward strategic initiatives rather than dealing with missed payments or reconciling discrepancies.

- Increase Customer Loyalty with Proactive Engagement

Recurring payment offers more than just consistent payments. It provides insurers with valuable data to enhance customer engagement and drive retention. By leveraging recurring payment data, insurers can detect trends such as late payments, policy downgrades, or potential cancellations. This insight allows for prompt action with tailored solutions, such as payment flexibility, personalized discounts, or policy adjustments, ensuring proactive resolution before issues escalate. According to Business.com, loyal customers, particularly those on recurring payment plans, tend to spend more than new customers. On average, returning customers contribute approximately 67% more in spending than first-time customers.

- Stay in Control with Transparent Pricing

Insurance business owners generally understand how complex and unpredictable premium structures can be, affecting both clients and their bottom line. Recurring payment offers a solution by providing transparency, making it easier for businesses to manage revenue and for clients to manage their premiums. With recurring payment, businesses can offer clients upfront pricing with no hidden fees or unexpected premium increases. This clarity helps clients plan and fosters trust, while also allowing businesses to streamline billing processes and improve cash flow management.

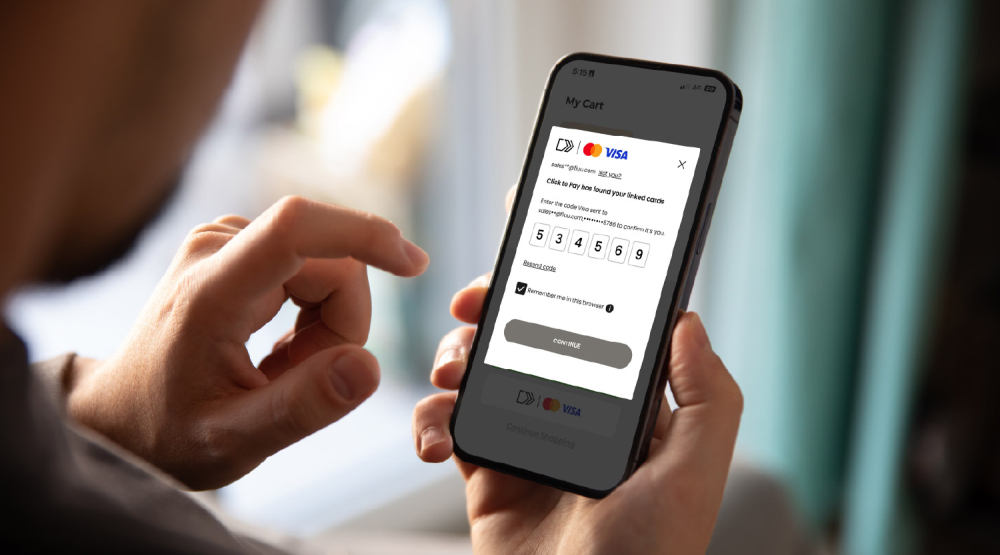

Why Choose Fiuu’s Recurring Payment?

Fiuu’s recurring payment system offers a seamless, user-friendly solution to handle these transactions automatically and securely. The table below offers a comprehensive comparison between Fiuu’s and Company X’s recurring payments, highlighting the key advantages and distinctive features that Fiuu delivers.

| Feature | Company X | Fiuu's Recurring Payment |

|---|---|---|

| Ease of Integration | Requires manual setup and potential system compatibility issues | Seamlessly integrates with existing platforms, reducing setup time and tech headaches |

| Payment Flexibility | Basic payment options (credit card, debit card, ACH) | Supports a wide range of payment channels, including e-wallets, bank transfers, cards, and more |

| Customer Experience | Limited customization options for customer needs | Fully customizable payment plans, discount options, and flexible renewal dates |

| Scalability | Often difficult to scale as customer base grows | Effortless scalability, managing thousands of policies without additional resources |

Fiuu as Your Recurring payment Partner for Success in the Insurance Industry

With Fiuu, insurance providers can seamlessly integrate recurring payment into their payment systems. Our secure, flexible, and scalable payment solutions simplify the transition, ensuring a smooth and efficient experience for both your business and your customers.

Ready to elevate your insurance business with recurring payment? Contact Fiuu today at [email protected] or register at https://booster.fiuu.com/ to explore how our advanced payment gateway can enhance customer relationships, drive business growth, and support long-term success in an increasingly dynamic market.