Scaling Your Business with Recurring Payments: Strategies for Growth in a Competitive Market

December 13, 2024

According to Statista, the e-commerce market in Southeast Asia was valued at around 159 billion U.S. dollars in 2024. It is projected to grow substantially by 2030, with an expected worth of 370 billion U.S. dollars. To stay competitive in the market, companies must adapt, especially subscription-based businesses, by starting to use recurring payments.

5 Strategies Recurring Payments Can Help Scale Your Business

- Streamlined Customer Retention

Harvard Business Review reports that acquiring a new customer can be 5 to 25 times more expensive than retaining an existing one. To reduce costs, companies can boost retention with recurring payment systems and automated billing, keeping customers committed without manual renewals.

- Reduced Churn Rates

A survey found that 42% of consumers were unaware they were still paying for subscriptions they no longer use. This highlights how consumers often stay with products offering recurring payments. By using recurring payment solutions, businesses can reduce churn with flexible billing options that match customers' preferences.

- Increased Customer Lifetime Value (CLV)

CLV is the total revenue or profit a business can expect to earn from a customer over the course of their relationship with the company. By using recurring payments, it increases CLV by ensuring repeat business throughout a subscription.

- Predictable Cash Flow

More than 80% of businesses fail because of cash flow issues, with 20% of small businesses closing within their first year and half shutting down within five years. This issue can be solved by implementing recurring payments, as they offer predictable revenue streams, making it easier to forecast earnings and plan marketing campaigns effectively.

- Simplified Marketing and Upselling Opportunities

In this competitive market, upselling plays a big role in increasing the average order value (AOV). With regular billing, businesses can create targeted marketing campaigns to upsell customers based on their previous subscriptions or purchases, increasing the average revenue per user (ARPU)

3 Benefits of Using Recurring Payments

- Stable Revenue Streams

Recurring payments provide a constant flow of income, making it easier to forecast and manage financials, especially during periods of rapid business expansion or seasonal events.

- Improved Cash Flow for Investments

With predictable payments, businesses can invest more confidently in new products, marketing campaigns, or infrastructure without the uncertainty of fluctuating revenue.

- Enhanced Customer Experience

Recurring payments reduce friction for customers by automating billing. This convenience fosters customer satisfaction, increasing the likelihood of long-term loyalty.

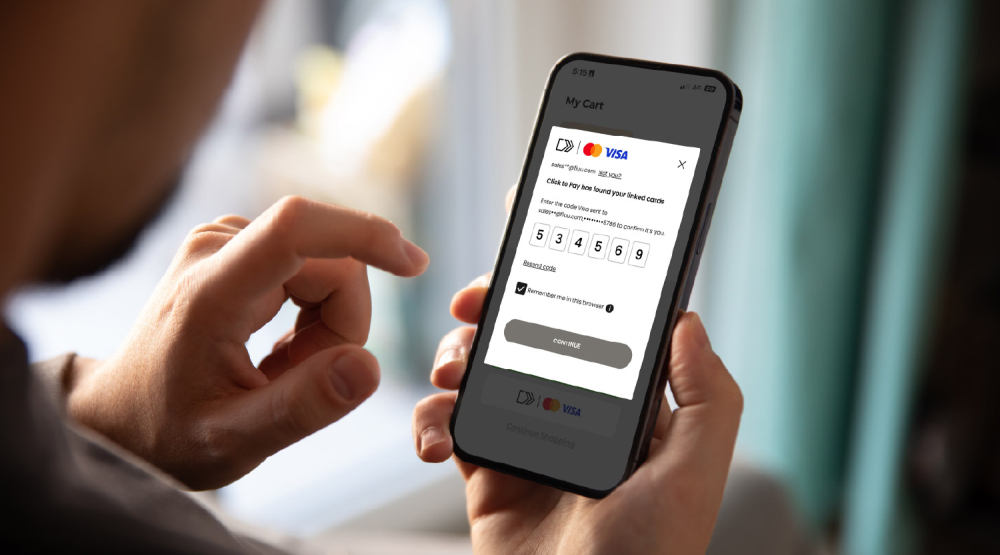

How Fiuu Can Help Your Business

- Simplify Payment Collection

Fiuu streamlines payment processes, eliminating manual follow-ups and invoicing, and helps you manage recurring payments instantly. With our team of 110+ experienced engineers managing high sales volumes during peak periods, your business can focus on scaling quickly while reducing administrative workload.

- Boost Revenue through Subscription

By supporting payments in the Southeast Asia region, Fiuu's subscription management tools allow you to set up and track recurring payments effortlessly. This means more time spent focusing on growing your business while ensuring a seamless payment experience for your customers.

In this competitive market, subscription payment methods benefit businesses by increasing revenue, customer loyalty, and reducing the likelihood of existing customers switching to competitors. With Fiuu recurring payments, your business can thrive, making it easier to manage payments and maximize growth potential in 2025.