How a Payment Service Provider (PSP) Helps You Accept All Major Payments and Scale Faster

July 31, 2025

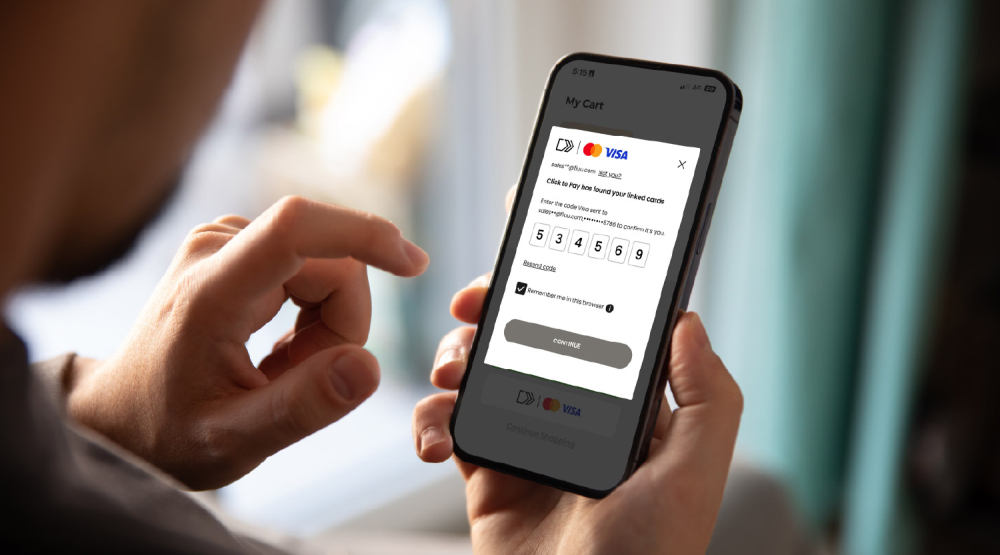

With digital commerce on the rise and customer expectations evolving, businesses need more than a great product to stay ahead. Fast, secure, and flexible payment options are essential for growth. That’s where Payment Service Providers (PSPs) come in.

According to Statista, global transaction value in digital payments is projected to reach USD 14.78 trillion by 2025—highlighting how crucial digital payment acceptance is for business competitiveness.

Whether you run an eCommerce brand, a SaaS platform, or a brick-and-mortar store going online, understanding what a PSP does—and how it supports your growth—is essential.

What Is a Payment Service Provider?

A Payment Service Provider (PSP) is a company that enables your business to accept online payments through various channels including:

- Credit & debit cards

- eWallets

- Online Banking

- QR Payments

- Buy Now, Pay Later (BNPL)

Instead of managing separate integrations and contracts with different providers, a PSP offers a single, simplified integration point for all major payment methods.

Key Benefits of Using a PSP

- Accept All Major Payment Methods

A PSP like Fiuu supports cards, eWallets, FPX, QR payments, and BNPL—all through one seamless integration. No more managing multiple vendors or payment contracts.

- Simplify Your Operations

Without a PSP, businesses must integrate and maintain separate connections with banks, card networks, and wallet providers. PSPs consolidate these into one platform, reducing operational workload by up to 40% (Deloitte Legal).

- Avoid Tech & Compliance Hassle

PCI-DSS compliance can cost RM20,000+ annually if managed in-house. Fiuu is already PCI-DSS certified, absorbing this responsibility so you stay compliant without the added effort.

What to Look for in a PSP

| Feature | Why it Matter |

| Easy Onboarding | Get set up quickly and start accepting payments fast. |

| Multiple Payment Method | Serve more customers with diverse payment options. |

| Real-time reporting | Monitor sales, track revenue, and make informed decisions. |

Why Businesses Choose Fiuu

Fiuu is more than a payment gateway—it’s a complete payment solution built for growth in Southeast Asia.

- Supports cards, FPX, eWallets, QR pay, and BNPL

- Real-time reporting & analytics for better decision-making

- Local support team that understands regional business needs

- Accepts payments across online, offline, and non-website businesses

With Fiuu, you improve cash flow, boost conversions, and simplify your operations—while staying compliant and future-ready.

Don’t let outdated payment systems hold your business back. With the right PSP, you’re ready to scale.

Contact us at [email protected] or register now at booster.fiuu.com