5 Ways Tokenization Can Protect Your Business from Fraud Risks

December 26, 2024

In today’s digital world, fraud and data breaches pose major threats to businesses, with the global cost of breaches reaching $4.45 million in 2023, and payment fraud being a key contributor. Tokenization is a powerful way to reduce these risks by replacing sensitive payment information with a unique identifier. Here are how tokenization can protect your business and how Fiuu’s tokenization technology offers enhanced security:

- Minimize Data Breach Impact

Tokenization minimizes the risk of data breaches by replacing sensitive information with tokens. Even if hackers breach your system, they only find tokens that are useless without decryption keys. This makes it much harder for fraudsters to misuse the data, significantly reducing both the financial and reputational impact of a breach.

- Reduce Payment Data Theft

Tokenization removes the risk of payment data theft by replacing sensitive information with tokens that have no value outside the transaction. This process ensures that even if the data is intercepted by fraudsters, the tokens cannot be used to make unauthorized purchases or access any valuable information, keeping both businesses and customers safe.

- Simplify PCI Compliance

According to PSI Security Standards, most organizations face challenges in maintaining PCI DSS (Payment Card Industry Data Security Standard) compliance because, as organizations grow, it becomes increasingly complicated to manage. Tokenization helps organizations reduce PCI compliance scope by ensuring sensitive data isn't stored, making cardholder data protection easier and cheaper.

- Enhance Transaction Security

Tokenization is a crucial safeguard against fraud because each token is unique to a specific transaction, making it impossible for fraudsters to reuse. By using tokenization, businesses can significantly reduce the risk of fraud by 26%, enhancing overall security and trust in the payment process.

- Reduce Fraud Liability

Since tokens don’t contain real payment information, businesses reduce their fraud liability as they face less exposure if fraudsters gain access to their system. By using Fiuu's tokenization, businesses can reduce the chances of fraud-related chargebacks, which cost merchants billions annually.

How Tokenization Can Scale Your Business Securely

- Faster Transactions

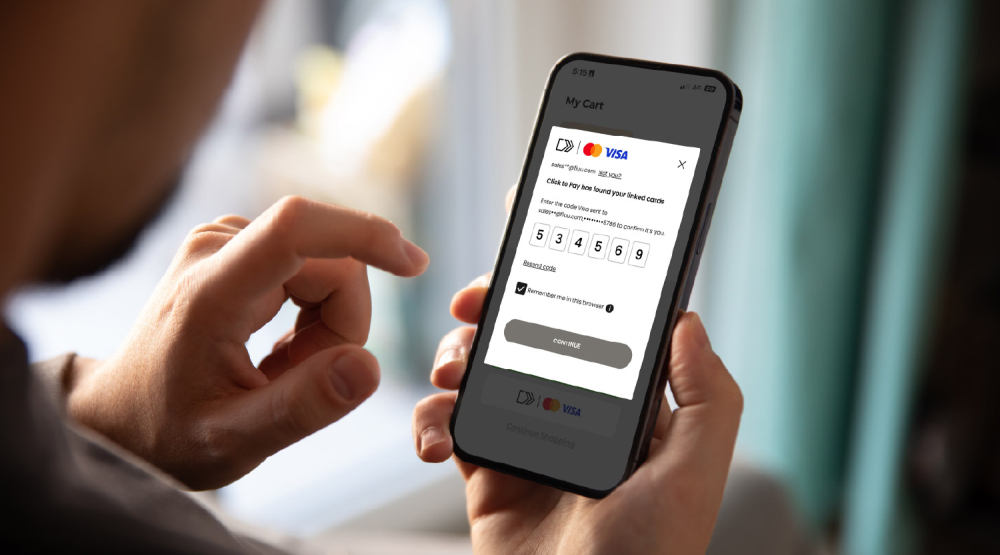

Tokenization speeds up payment processing by removing the need to handle sensitive data, making transactions quicker and more efficient. With tokenization, customers are only required to provide the Card Verification Value (CVV) or One-Time Password (OTP) on the payment page.

- Increase Customer Trust

Tokenization helps build customer trust by protecting their sensitive payment information, which leads to higher customer loyalty. When customers see that a business prioritizes security and protects their data, they are more likely to trust the payment process and make repeat purchases.

- Support Global Expansion

Tokenization makes payment processing safer across different currencies and regions, eliminating the need to store sensitive data in multiple locations. With global e-commerce sales expected to reach $7.4 trillion by 2025, businesses can expand internationally while staying compliant with local data protection laws. Fiuu’s tokenization supports secure global transactions, enabling your business to scale internationally with ease.

Secure Your Business with Fiuu Tokenization

Tokenization is essential for businesses to prevent fraud and comply with data security standards. By replacing sensitive payment data with Fiuu's secure tokens, businesses can reduce the risk of breaches and scale confidently, without worrying about security issues.