The Basic of Payment Gateway: What is it and how it works?

May 15, 2017

Online transaction is the fast and convenient way for users to settle payment. Due to the internet that can be reached globally, everyone can easily sell or buy all around the world.

Online transaction can be difficult to verify and mostly anonymous.

Due to that, e-commerce payment security is important in order to avoid problems such as fraud to happen within the operation.

Merchants need to take a proactive approach to reduce the fraud within online store and prevent security breach of cards or personal data. One of the ways to prevent it is by using payment gateway.

The Payment Gateway

Payment gateway is an e-commerce software that authorizes payments for online merchants, e-businesses or electronic business, bricks and clicks or traditional brick and mortar businesses.

It seamlessly connects to e-commerce or in-house payment processor for examples, credit cards processing networks or online banking.

Payment gateway is a third-party between merchants and customers that securely take the money from customers and send it to merchant's’ bank account. Payment gateway is a virtual equivalent of a physical point-of-sale terminal that located in most of retail outlets.

How it works?

Payment gateway performs the important role in processing and authorizing the payment or transactions between customer and merchants.

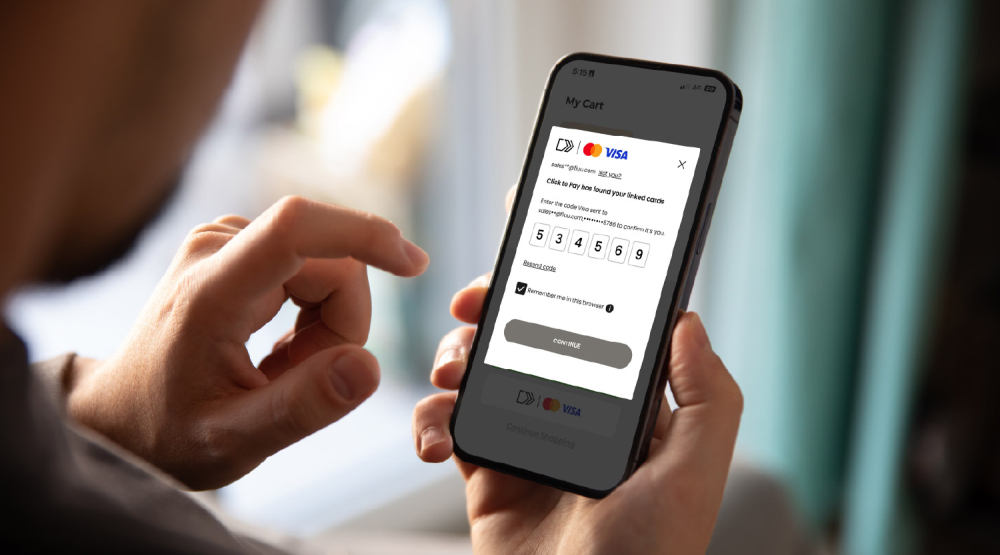

Payment gateways encrypt sensitive information and details of payment such as credit cards number. It is to guarantee that the information is passed securely between customer and merchant. Here are the basic steps on how it works:

Step 1: A customer will place an order on the website that they visit by submitting the order, checkout from the cart or any equivalent button.

Step 2: Merchant securely transfers order information to the payment gateway. Customers will pay with their preferred payment method. The transaction is then routed to the issuing bank or the 3D secure page to request transaction authentication.

Step 3: After the authentication process is successful, the transaction is then authorized or declined (depending on funds available in the customer’s account) by the issuing bank or card (Visa, Master, American Express).

Step 4: Payment gateway sends a message to the merchant accordingly.

Step 5: The bank settles the money with the payment gateway and then the payment gateway settles the money to the merchant.

When using payment gateways, there are three important things that they do when customer wants to make purchase from the merchants’ website. It is either by using credit card, debit card, online banking, cash etc. The three important things are including authorization, settlement and reporting.

Payment gateway providers also provide merchants with other benefits such as virtual terminal that can help receiving payment in the physical outlets through the same methods of payment.

By using a payment gateway, it puts the control of business payment acceptance into your hands hence raising the power to grow business right through your fingertips.

To find out more about payment method for your business, contact Fiuu. We are very happy to assist you.