3 Proven Ways Fiuu Helps APAC Merchants Grow Sales

July 17, 2025

As Asia Pacific (APAC)'s digital economy continues to thrive, businesses that rely on a single payment method may risk losing out on significant opportunities. Research indicates that, on average, 34% of consumers prefer payment cards, 26% favor mobile wallets, and another 26% still choose cash as their preferred method. These fragmented preferences show why offering multiple payment channels has become a competitive necessity for businesses looking to increase conversions and meet customer expectations.

Let’s explore what payment channels are — and why they’re key to unlocking growth in the region.

What Are Payment Channels?

Payment channels are the various ways businesses accept payments — from traditional methods like cash and credit cards to digital options like e-wallets, online banking, QR payments, and even Buy Now, Pay Later (BNPL), even newer technologies like cryptocurrencies.

In the APAC region, preferences vary significantly by market:

| Country | Popular Payment Methods |

| Malaysia | Touch ’n Go, Boost, FPX |

| Singapore | Credit Cards, PayNow, GrabPay |

| Philippines | GCash, Maya, BNPL |

| Thailand | QR Code Payments, TrueMoney |

To serve this diverse customer base effectively, merchants must offer localized, flexible payment options.

3 Strategic Advantages of Offering Multiple Payment Channels

-

Increase Conversion Rates by Offering Diverse Payment Options

According to Visa’s 2023 Digital Payment Trends report, 70% of APAC consumers prefer digital payment methods, especially mobile wallets and e-commerce-friendly solutions.

By supporting multiple channels, businesses can drastically reduce checkout drop-offs and offer customers the convenience they expect.

How Fiuu Can Help: Fiuu integrates over 110 payment channels, including credit cards, e-wallets, online banking, and more, making it easier for your business to boost conversion rates and reach a larger customer base.

-

Enhance Customer Engagement with Local Payment Methods

Across APAC, payment behavior is deeply influenced by local preferences. What works in Malaysia may not work in Thailand — and businesses that fail to localize risk losing customer trust.

In the Philippines, GCash is dominant; in Thailand, QR code payments and TrueMoney are widely used. Customers are more likely to complete a purchase when they recognize and trust the payment options at checkout.

How Fiuu Can Help: As the best payment gateway in APAC, Fiuu supports region-specific payment methods like GrabPay, ShopeePay, Touch ’n Go, AliPay, PayNow, and more — helping businesses build familiarity and confidence with their customers in each market.

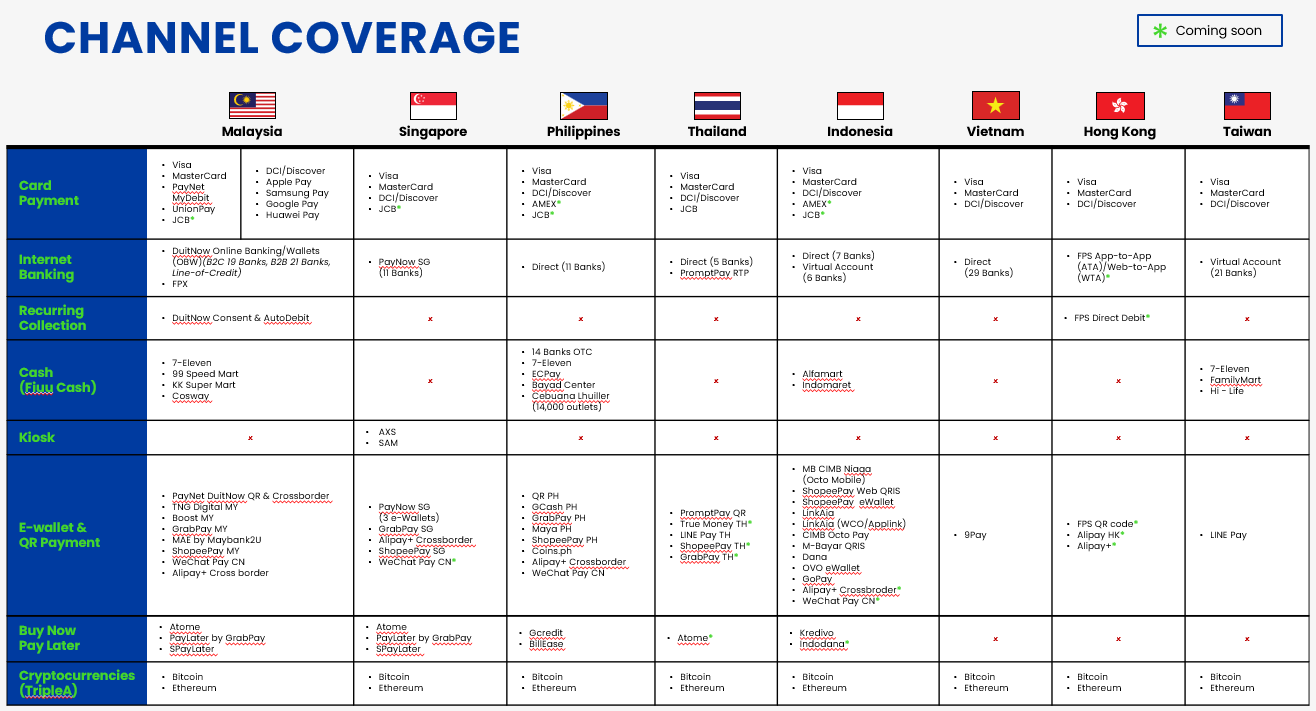

Fiuu offers coverage for over 110 channels across APAC including Malaysia, Singapore, Philippines Thailand and more, as detailed below:

As of 8th April 2025

-

Improve Cash Flow with Flexible Payment Options

Flexible payment methods aren’t just about convenience — they directly impact your bottom line. One powerful example is Buy Now, Pay Later (BNPL).

According to TNGlobal, the BNPL market in APAC is projected to grow from $14.7 billion in 2023 to $53.2 billion by 2027 — a CAGR of nearly 39%. Businesses that adopt BNPL options not only see more completed purchases but also increase average order values and repeat transactions.

How Fiuu Can Help: Fiuu enables businesses to accept a variety of BNPL solutions, such as Atome, PayLater by Grab, Kredivo, Indodana, and GCredit, allowing businesses to cater to a growing demand for flexible payment options and boost their revenue potential.

Why Fiuu is Your Ideal Payment Partner in APAC

With Fiuu, businesses gain access to an advanced, scalable payment gateway designed to meet the dynamic demands of the region. Fiuu delivers a comprehensive payment infrastructure that helps businesses streamline their payment processes and enhance the customer experience:

- Accept over 110 local and global payment methods in one integration — including e-wallets, online banking, cards, and BNPL.

- Offer localized checkout experiences that reduce friction and increase conversions.

- Improve cash flow through smart integration with flexible payment options.

- Scale easily across markets like Malaysia, Singapore, the Philippines, Thailand, and more.

Ready to Power Growth Across APAC? Join thousands of merchants using Fiuu to boost conversions, improve customer experience, and expand regionally with confidence. Sign up now at https://booster.fiuu.com/ or contact us at [email protected].