Understanding and Preventing Payment Fraud: A Guide for Businesses

November 15, 2024

In an increasingly digital world, payment fraud has become a top concern for businesses of all sizes. Fraud not only disrupts operations but also leads to financial losses, damages trust with customers, and can tarnish a brand’s reputation. By understanding the different types of fraud and implementing preventive strategies, businesses can protect themselves and their customers more effectively.

Types of Payment Fraud to Watch Out For

- Card-Not-Present (CNP) Fraud

CNP fraud occurs when transactions are made without the physical presence of the card, such as online purchases. This type of fraud is common in e-commerce and can result in significant losses for businesses without robust fraud detection systems.

- Account Takeover (ATO)

ATO fraud happens when cybercriminals gain access to a user’s account, often through phishing, stolen credentials, or malware. Once in control, fraudsters can make unauthorized purchases, leading to chargebacks and financial loss.

- Friendly Fraud

This occurs when a legitimate customer disputes a transaction, sometimes unknowingly, claiming they didn’t make the purchase. Businesses often bear the cost of chargebacks from these disputes.

- Refund Fraud

Fraudsters exploit refund policies by purchasing items and returning counterfeit versions or requesting refunds without returning any products.

- Identity Theft

Cybercriminals steal personal information to impersonate someone else, allowing them to make unauthorized purchases. Identity theft can impact both businesses and their customers.

How to Protect Your Business from Payment Fraud

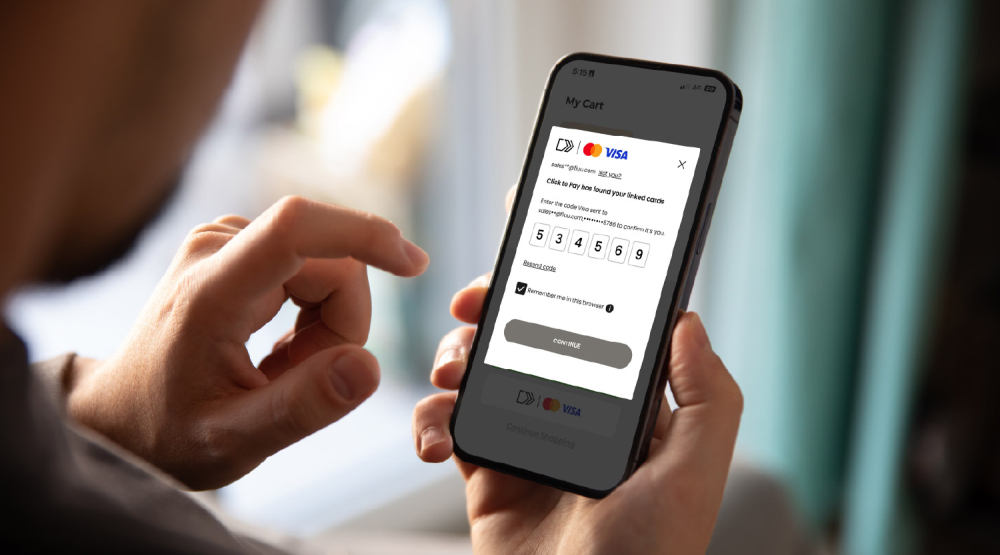

- Implement Strong Authentication Measures

Using two-factor authentication (2FA) or multi-factor authentication (MFA) adds an extra layer of security. This helps prevent account takeover by requiring additional verification beyond a password.

- Use Advanced Fraud Detection Tools

Invest in AI-powered fraud detection tools that can flag suspicious activity in real time. These systems analyze transaction patterns and alert businesses to potential fraud before it occurs.

- Regularly Update Security Protocols

Ensure all payment software and platforms are up to date. Regularly updating software helps fix security vulnerabilities and reduces exposure to new threats.

- Educate Customers on Fraud Prevention

Encourage customers to use strong passwords, avoid sharing their personal information, and recognize phishing scams. Educated customers are less likely to fall victim to fraud, reducing the risk for businesses.

- Monitor Transactions for Anomalies

Set up systems to monitor transactions in real time. Look for unusual transaction patterns, such as large purchases from new locations or sudden changes in buying behavior, and flag them for review.

- Implement Chargeback Management Strategies

Proactively manage chargebacks by keeping thorough records of transactions and following up on disputes. A robust chargeback management process can help minimize losses from friendly fraud and disputed transactions.

- Establish Clear Refund Policies

Transparent and well-communicated refund policies can reduce refund fraud. Ensure your policies require verifiable information for returns to prevent abuse.

The Role of a Payment Gateway in Fraud Prevention

Partnering with a secure payment gateway can significantly bolster a business’s fraud prevention efforts. Payment gateways provide:

-

Encryption for sensitive data, protecting information as it moves between customers and businesses.

-

Real-Time Fraud Detection that uses machine learning to flag suspicious activities before they escalate.

-

Chargeback Management Tools to reduce the burden of disputes and recover revenue lost to friendly fraud.

Preventing payment fraud is an ongoing effort that requires vigilance, the right tools, and a proactive approach. By staying informed about emerging fraud tactics and investing in robust fraud prevention measures, businesses can minimize their risk and build trust with customers. Remember, a secure payment process not only protects your bottom line but also enhances your reputation as a trusted business.