5 Payment Trends in E-Commerce to Watch out for in 2020

February 04, 2020

The payments ecosystem in e-commerce is fast becoming a hub of opportunity, with trillions in volume and billions in revenue up for grabs. 2019 saw a massive up-swing in revenues and opportunities in the e-commerce payments industry, setting the stage for an intense 2020.

Innovations in the payments industry have fired up serious growth in e-commerce itself, with worldwide sales anticipated to top $4 trillion in 2020. Malaysia’s $4 billion e-commerce market has also enjoyed a mammoth 47.8% growth rate in 2017 and expected to expand at a CAGR of 24% till 2021.

This is also symptomatic of the rapid growth in payments across Southeast Asia. Much of the growth is fueled by developments within financial technology such as in-app purchasing, wider payment options and e-wallets.

As better and smarter options are being provided for online payment, consumers are getting more comfortable with shopping and paying online. Payment systems are getting more secure and efficient, making them attractive for consumers and businesses alike.

In this flurry of opportunities, the savvy e-commerce merchant should have an eye firmly on the trends that underpin this growth and how they will shape the e-commerce industry in the year to come.

This article examines the trends and what they might mean for e-commerce businesses that want to stay ahead of the competition in 2020.

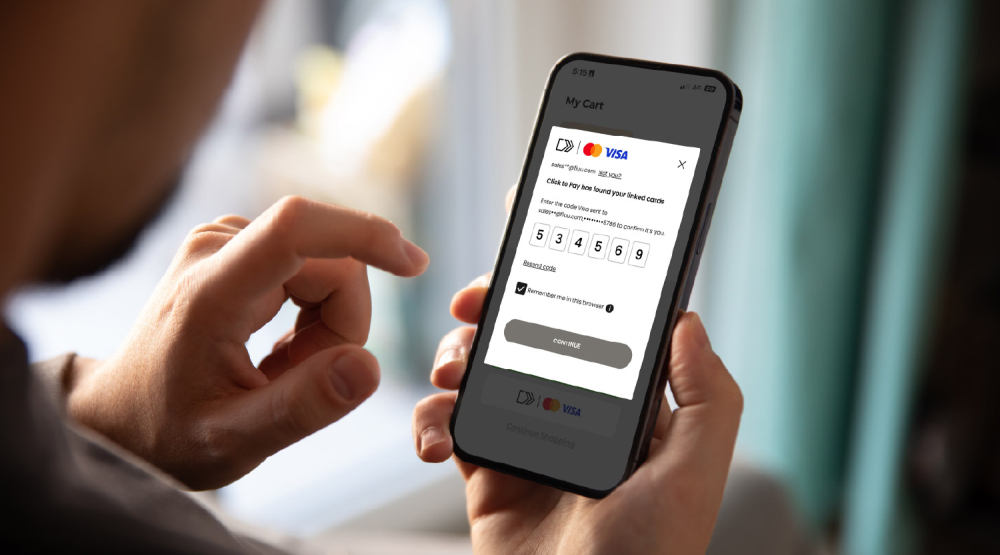

#1: Mobile payments

For a long while now, mobile transactions have been competing hard against in-store purchases and transactions on desktop computers. This trend is set to continue in 2020 as m-commerce will get faster and even more fluid with progressive web apps that blur the lines between sites and mobile apps.

It is expected that mobile commerce will constitute 49% of worldwide e-commerce revenue by 2020. Although mobile payments are nothing new, there is increasingly widespread acceptance around the world, and this is fuelling serious growth.

Visa reports that sales through mobile devices have grown at a rate 53% faster than sales made on computer. But the trend is even stronger in Asia. In China alone, total mobile payment amount for 2018 was $40 trillion, compared to $125 billion in the US.

There are several reasons for the acceleration in acceptability of mobile payments. Two of these reasons that bear closer scrutiny are the rise of social media transactions and the QR Code.

The acceleration of smartphone penetration (66% in the region and 73% in China by 2020) has helped boost the popularity of QR codes for payments. Since they are independent and easy to set up, QR codes provide more back-end speed and reduced fraud possibilities compared to credit and debit-card transactions.

Social networks are no longer simply platforms for social engagement. They are now e-commerce platforms in themselves, and marketers now utilize the more popular platforms to sell their products and accept payments.

#2: Multi-channel selling and personalization

In the quest to make payments easier and smoother, more businesses are working to introduce multiple payment channels. There is plenty merit to this as multi-channel communications have up to 166% higher engagement than single-channel.

Merchants are incorporating a host of new payment arrangements that aim to engage more customers and cater to new ones. Some of the current trends here include “buy now pay later”, “buy online pick up in store” and “contactless checkout”.

Recall that the online payments landscape mostly caters to millennials and Gen Z who demand freedom and choice. Businesses are expected to cater to this demand by providing more options.

It is already reported that cash payments are decreasing while the use of credit cards and digital wallets are increasing, especially amongst younger buyers. Although digital wallets are currently the fourth most used payment option in Malaysia, at just 7%, this payment method is expected to grow sharply between 2019 and 2021, at a CAGR of 53%. By 2021, JP Morgan expects that digital wallets will have a share of 16% in the Malaysian payments landscape.

The smart merchant should look critically at its demographics and adopt payment solutions that are relevant to that demographic.

Just as they want more payment options, customers and prospects also demand personalized experience, according to 88% of marketers. Businesses that hope to satisfy this demand will be expected to provide a personalized experience across all channels.

#3: Payments security

Without doubt, security will be a crucial factor in how the industry shapes up in 2020. With the growth of mobile payments and smartphones, the increasing popularity of these payment methods makes them a security target.

Bankers, payment processors and businesses view security as one of the top challenges in the payments industry. In light of the projected $31.3 billion global card losses in 2018, there is a great incentive to out-innovate fraudsters in the coming year.

With so many payment options being made available to businesses and consumers, it is expected that only those that can guarantee a secure payment experience will get ahead in the coming year.

Current measures to beat back fraud and increase security include SMS phone verification. Others involve AI that uses active learning risk identification algorithms to scan various transactions and ensure that the information has not been hijacked.

#4: Smarter and frictionless payments

The necessities of ensuring security in payments may however have their own drawbacks. Stronger security systems may include more authentication steps that prolong the payment experience.

The EU’s Payment Service Directive (PSD2) faces this challenge. Its Strong Customer Authentication (SCA) requirements will require at least two authentication steps to verify electronic payments. This may cause more friction in the payment process.

If there’s anything consumers dislike, it’s having to wait longer to complete their purchase. Research from Amazon indicates that each additional click made by the customer increases basket abandonment rates by 15%. The Baymard Institute also reports that, of the 70% of customers that abandon their carts, 23% do so because of a long or complicated checkout process.

A 2019 study by the Emerging Payments Association already accepts that the SCA requirements will increase transaction decline rates by 25-30%, from today’s 3%.

The challenge faced here is not limited to the EU. Businesses that want to make a promise on security must find a way to seamlessly incorporate any extra steps if they will forestall higher cart abandonment through measures such as tokenization.

#5: Customer service automation

As consumers gain greater control over the e-commerce industry, they require better and swifter service. This includes having their complaints about the payment process and other matters taken care of within a very short period.

The reward of great customer service is a loyal customer. Statistics show that 42% of retail customers will buy more after receiving good customer service. The reverse is also the case, with 52% taking their business elsewhere if they are unsatisfied.

With the increasing volumes of global e-commerce sales, it is nigh impossible for businesses to attend to customers using only manual support. It makes better sense for payment solutions to have technology that replaces manual support instead.

As more businesses toe this line, it is already expected that up to 85% of customer interaction in 2020 will occur without a human. 31.7% of major businesses already use AI to augment their customer support. Chat bots have especially become very popular and will continue to be in demand in 2020.

Make global possibilities reality

By incorporating effective payment solutions with secure multi-channel adaptation, businesses can seamlessly sell across borders. Having an efficient payment processor and payment gateway provider can provide the key for high-value growth and scaling in the coming year.

As Southeast Asia’s leading payment gateway, Fiuu has collaborated with innumerable businesses to drive growth and revenue. Our online payment gateway is second to none, and our services are constantly adapted to take advantage of current trends to keep your business on top.

Are you ready for your e-commerce platform to reach the next level in 2020? Connect with a payment processor that can help you scale effectively. Reach out to us today.