Recent Online Scams That You Should Beware Of

February 18, 2020

Whenever you log on to banks and financial institutions, have you noticed that they always remind you not to be a victim of online scams and fraud and share tips & tricks on how to avoid them? It is clear why we should always be wary when we are online.

Recently, online scams have become increasingly sophisticated and extremely alarming. You might be chatting with someone that seems trustworthy but a few seconds after, you could become a victim.

Why is that so?

Being online, the first thumb rule is – be wary of everything you see or anyone you have never heard from ever!

Based on real scenarios, here are five (5) things that you should be suspicious of:

1. Don’t communicate outside trusted platform

For online sellers, do not trust customers who ask you to communicate outside the online shopping website. Once the communication happens outside of trusted platforms, it is out of the merchant’s and payment gateway’s control. Whatever the matter is, it should be strictly communicated inside the platform.

Example:

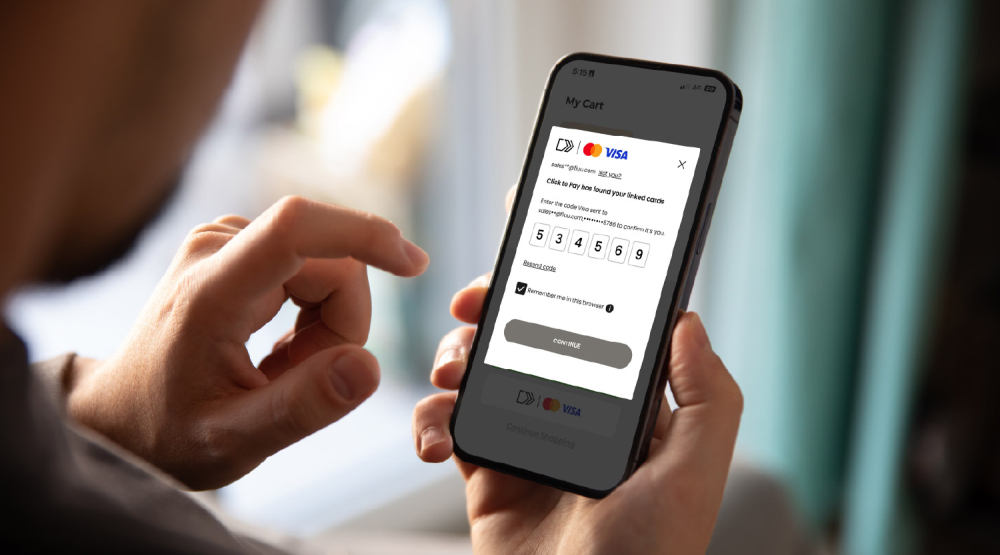

2. Don’t share your OTP with others

Please remember that your (One Time Password) OTP should be kept only for your eyes. Do not give it to others. Individuals who ask it for it out of nowhere are most likely out gain access to verify an account or steal information.

Example:

3. Don’t give your account details to others

We received several complaints that users were scammed by social media acquaintances who pretended to be someone they are close with. It begins with small interaction to gain trust which ends with one that dives into the sharing of personal details.

Example:

4. Don’t fall in “winning” easily

As the adage goes “If it’s too good to be true, it most likely is”. However, many have fallen into these traps and give private details in order to be eligible of winning. With high hopes to win, most victims had their money stolen instead.

Example:

5. Don’t go on unsecured website

When it involves a website or link, please avoid going to the ones without ‘s’ in the “HTTP” and padlock icon - both stand for secure.

Example:

If you come across these situations, what should you do?

- Don’t click on it

- Think before you reply

- Don’t open suspicious messages

- Be on the lookout for telltale scammer signs, e.g. the unprofessional use of language

The messages, whether it comes from a trusted seller that you always shop from or from financial institution that you have an account with, it is generally a good idea with treat the message with a bit of skepticism, because it might not be “them”. This method of scamming called phishing, generally will rely on an fraudulent attempt to obtain sensitive information such as usernames, passwords and credit card details by disguising oneself as a trustworthy entity in a communication.

It is of your own initiative to keep your information private when it comes to interactions that happened outside of our secured perimeter. Keep the communications strictly on trusted platforms. We always care about your security while making any transactions online - be extra careful.

You can understand more about these issues on your respective bank’s website.