How eWallet Integration Makes Installment Payment Seamless and Profitable

February 06, 2025

Within the rapidly evolving Asia Pacific market, eWallets are the most popular method, accounting for almost 70% of e-commerce payments in the region. eWallet integration has become a popular solution for businesses looking to offer installment payments that make transactions faster for their customers. Below are 5 business advantages that eWallet integration can offer to streamline payment plans.

- Global Reach with Local Payment Methods

eWallets often support a wide range of local payment channels, which means businesses can offer flexible payment plans in different regions, especially in Southeast Asia.

Why It Matters: In Southeast Asia, the user base for mobile is projected to reach 440 million by 2025, thanks to the increasing trust in digital payment. Businesses can expand their customer base internationally by offering local eWallet solutions for installment plans.

- Streamline Payment Processes for Businesses

eWallets provide businesses with a streamlined payment process that reduces the time spent managing payment plans, including installment-based options.

Why It Matters: Research from Cornerstone reveals that 68% of employees have suffered from work overload due to handling manual payment processes. To resolve this issue, Fiuu’s installment payment can eliminate manual intervention, allowing businesses to focus on growth with error-free payments.

- Scalability and Flexibility for Growing Businesses

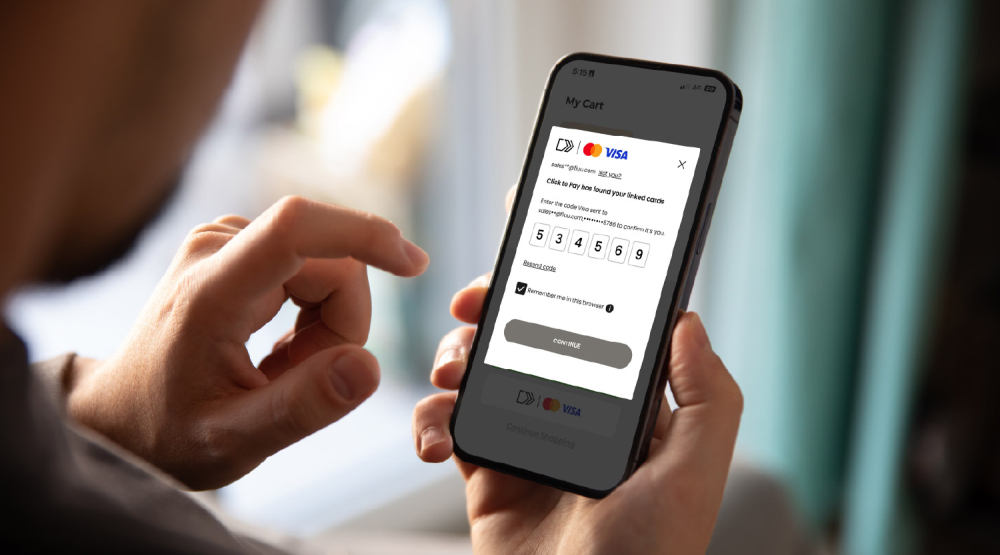

eWallet integration allows businesses to offer installment payment directly through their digital wallets.

Why It Matters: According to Juniper Research, global eCommerce sales are expected to reach $11.4 trillion by 2029 due to the increasing use of flexible instalment payment options, with eWallets playing a central role in this trend. By allowing seamless transactions within the wallet, businesses can easily offer these payment plans, giving customers more control over their purchases.

- Enhancing Business Security with Tokenization

eWallets use tokenization to replace sensitive payment data with a unique token. This process helps reduce the risk of fraud and data breaches.

Why It Matters: By 2026, it is expected that 60% of the world’s population will use digital wallets as their primary payment method due to the security of transactions. By embracing e-wallets, businesses can ensure that their customers' data remains protected.

- Easier Tracking of Payment Schedules

eWallets provide an easy way for customers to track their payment schedules, as they can view due dates, remaining balances, and past payments in the app.

Why It Matters: A study found that 62% of Malaysian consumers preferred using the Touch 'n Go wallet over online banking. This demonstrates a shift in consumer preferences toward using e-wallets, driven by the easier onboarding process compared to traditional banking methods. With Fiuu, businesses can integrate popular eWallets from Southeast Asia and easily track installment payment schedules for customers.

Leverage eWallet Integration for Success with Fiuu

-

Comprehensive Payment Gateway

Fiuu offers a comprehensive payment gateway that supports a variety of payment channels, including eWallets, credit/debit cards, and bank transfers. This broad acceptance of payment methods ensures businesses can cater to different customer preferences, both locally and globally. -

Ease of Integration

Fiuu’s installment payment solutions offer easy integration with minimal setup time, so businesses can start accepting payments quickly without disruption to daily operations. It's designed to seamlessly integrate with existing infrastructure, whether you are a small enterprise or a large corporation.

Ready to optimize your payment system and drive profitability? Contact Fiuu today at [email protected] or register at https://booster.fiuu.com/ to integrate eWallet solutions into your business and unlock the full potential of installment payment plans.