3 Key Considerations for the Right Payment Gateway in the Philippines

November 14, 2025

As Southeast Asian nations accelerate their digital transformation, the Philippines has quickly been emerging as one of the region’s most dynamic digital economies.

According to the Visa Consumer Payment Attitudes 2024, the Philippines recorded the second highest mobile wallet usage in Southeast Asia at 87%, on par with Malaysia and just below Indonesia.

By 2026, The World Bank projects that digital payments will account for 56% of transactions in the Philippines, with the number of e-commerce enterprises growing by 45% to reach 3.5 million.

With this rapid transformation, businesses in the Philippines need a reliable and future-ready payment gateway to remain competitive and ready for any opportunities that will arise.

3 Key Considerations When Choosing a Payment Gateway in the Philippines

-

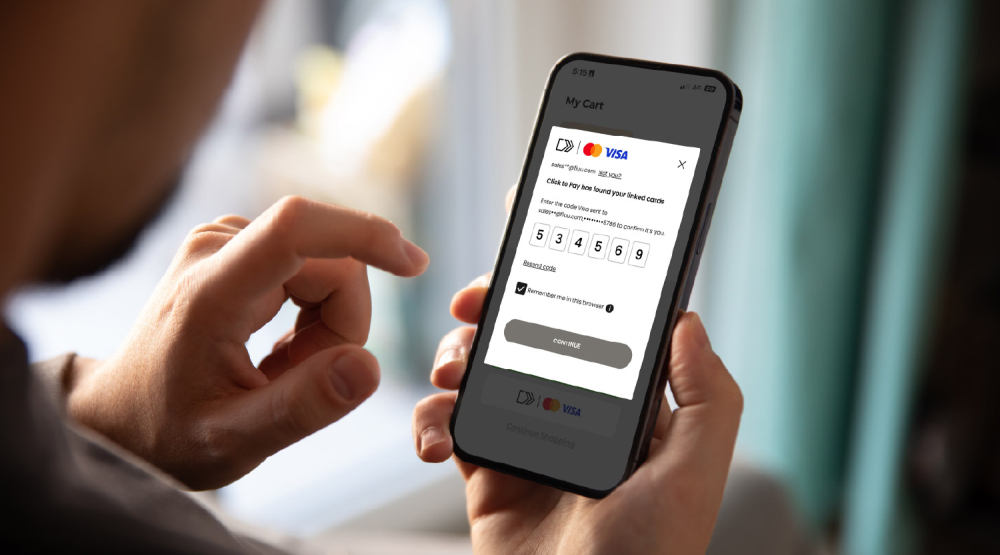

Flexible Payment Methods, Easy Integration

While cash remains dominant in the Philippines, a survey by Delivery Hero (foodpanda) finds 49% of Filipinos now prefer digital payment methods like e-wallets and cards. Meanwhile, Buy Now Pay Later (BNPL) usage has also surged nationwide to 54% in 2024.

To keep up, businesses need a payment gateway that supports all major payment methods from cash, card, e-wallets and more, through a single integration, allowing customers to pay their way at checkout while reducing setup costs and time.

-

Strong Uptime Performance & Scalability

Peak sales days such as Black Friday, Cyber Monday, and Singles Day bring massive traffic to online shopping marketplaces like Shopee, Lazada and Amazon.

To maximize conversions, businesses need a high-uptime payment gateway built on scalable infrastructure that can handle peak volumes seamlessly.

-

Enterprise-grade Security and Compliance

Security and compliance are non-negotiable for digital payments, as it directly affects consumer trust and revenue.

When choosing a payment gateway, businesses should ensure that it is recognized by the Central Bank (BSP) and certified with PCI-DSS and ISO27001:2022 standards to ensure full protection for your business and customers.

Recommended Solution: A Payment Gateway Built for the Philippines

Empower your business with a future-proof, enterprise-grade payment gateway built for scalability and trust.

Why choose Fiuu:

-

Single API for All Payment Methods: Accept every major payment method in the Philippines including cash, card, e-wallets, BNPL and more through a single API integration.

-

Track Record in Scalable Infrastructure: Proven to be able to handle peak traffic spikes across all our channels and industries.

-

Certified by the BSP & Enterprise Standards: Fiuu is registered with the Bangko Sentral ng Pilipinas (BSP) and fully compliant with PCI-DSS and ISO27001:2022 standards.

Trusted by 70,000+ businesses across Southeast Asia, Fiuu helps businesses simplify, optimize and scale their digital payments.

Register as a merchant today at https://booster.fiuu.com or reach us with any enquiries at [email protected] — we’re always ready to help!