Click to Pay: A Smarter Way to Reduce Checkout Friction at Scale

January 20, 2026

Overview

As digital payments continue to thrive in 2026, consumers are turning towards merchants with the most streamlined checkout. Agility on the payment page is no longer an advantage, but a necessity.

While reducing friction to create a truly seamless checkout is essential for merchants, it cannot come at the cost of trust. According to a KPMG survey, security remains the number one priority for 65% of APAC consumers, outpacing convenience (58%) and speed (40%).

For merchants and businesses, Click to Pay combines security, convenience and speed to reduce friction and maintain trust at scale. Enabling it is easy with a supported Payment Service Provider (PSP) like Fiuu.

How Click to Pay Helps in Reducing Checkout Friction

Checkout friction affects merchants of all sizes, but its impact multiplies as transaction volume grows. Even minor delays, repeated card entry, or confusing forms can lead to abandoned carts, frustrated customers, and lost revenue.

Click to Pay addresses these challenges by simplifying card payments into a few clicks, creating a faster, smoother checkout. The experience is consistent across major card networks, including Visa and Mastercard, allowing customers to pay securely without unnecessary steps.

According to Mastercard, merchants offering Click to Pay achieved an average checkout conversion rate of 96% and reduced checkout times by up to 50% by removing manual entry of card details.

How Does Click to Pay Work?

Click to Pay is a standardized one-click checkout solution based on EMVCo standards that eliminates manual card entry.

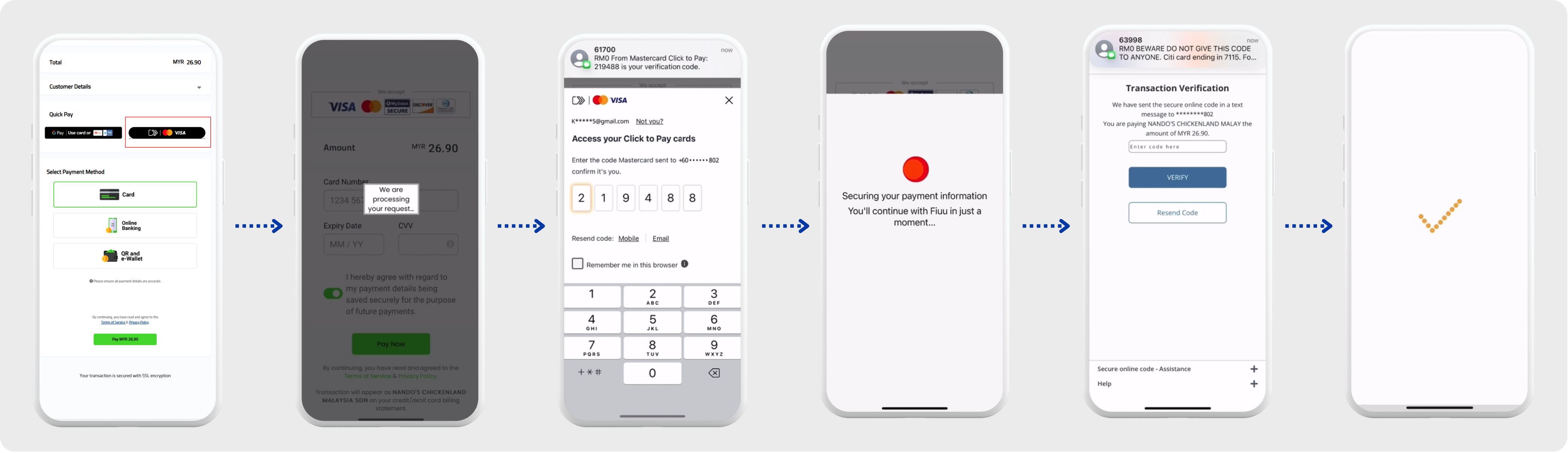

Here’s how it works for your customers:

Step 1: Customers look for the Click to Pay icon at checkout when making a purchase.

Step 2: Create a Click to Pay account. *This is only required for first-time Click to Pay customers.

Step 3: Select the saved payment card you want to use.

Step 4: Card information, billing address, and other necessary details are securely and automatically filled.

Step 5: Depending on the card network and issuer, customers may verify their identity through a familiar method like OTP, device recognition, or app approval.

Step 6: The transaction is authorized and confirmed within seconds, allowing the customer to complete their purchase without delays or friction.

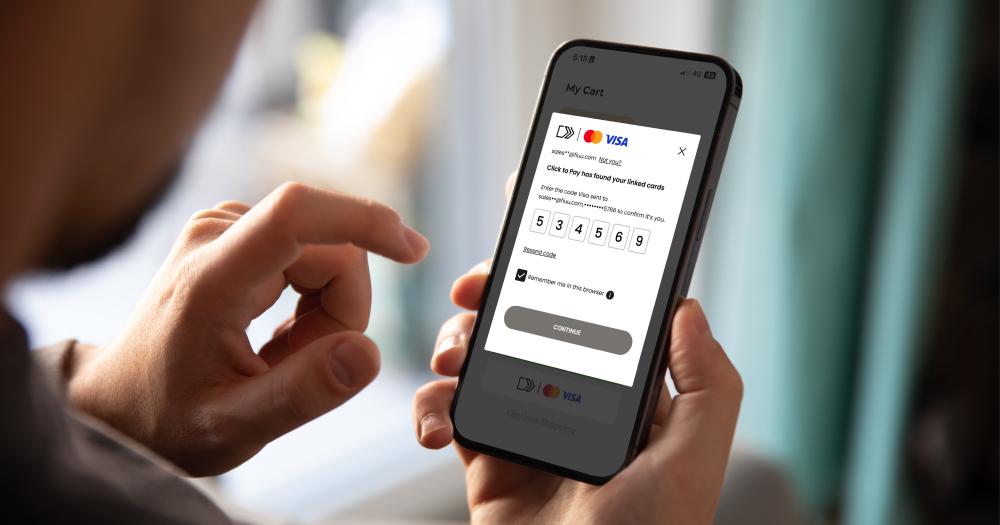

The image below shows the user journey of a customer completing their purchase with their mobile phone, using Click to Pay.

For merchants, this experience translates into faster checkouts and fewer abandoned carts. The cards saved on Click to Pay are protected by the network’s robust security frameworks, ensuring your customers’ data stays theirs.

Should I Implement Click to Pay for My Business?

Yes. Click to Pay is not just a solution for existing checkout problems, it is a universal tool to amplify speed, convenience, and frictionless customer experience at the payment page, regardless of industry and size.

Merchants who offer Click to Pay are essentially offering a fully seamless and secure card checkout, all done via a mobile phone or on their website.

Integrate Click to Pay Into Your Checkout Today with Fiuu

As a licensed direct acquirer for Mastercard, merchants onboarded with Fiuu can easily integrate Click to Pay into your checkouts, no need for fragmented integrations and setup.

Enhance your payment page today at https://booster.fiuu.com or email us at [email protected] for more information.