5 Effective Ways to Reduce Business Churn with Recurring Payments

January 24, 2025

In Southeast Asia's competitive landscape, reducing churn is as crucial as customer acquisition, especially for businesses relying on recurring payments. According to Bain & Company, Southeast Asia's internet economy is experiencing rapid digital transformation and is projected to reach $263 billion, a 15% increase over last year.

What is Recurring Payment?

A recurring payment system is one where a customer agrees to pay a business automatically at regular intervals, such as weekly, monthly, or yearly for ongoing services or subscriptions. Below are five strategies to reduce churn with recurring payments and how Fiuu can optimize them for your business:

- Automate Billing and Payment Collection

Issue: Manual billing processes are prone to mistakes, which can cause delayed or missed payments. As a result, customers may leave, and the business could see an increase in churn.

Solution: Research found that 15.92% of users churn due to dissatisfaction with the business services. By automating payment collection processes, businesses can significantly reduce the risk of human error, ensuring that transactions are completed accurately.

- Use Recurring Payments to Build Long-Term Customer Relationships

Issue: Customers often cancel subscriptions when they feel disconnected or when their needs are no longer being met. According to SuperOffice, 62% of customers canceled their subscriptions due to negative experiences with customer service.

Solution: Recurring payments provide a consistent opportunity to engage with customers, offering businesses a chance to nurture long-term relationships. This steady flow of transactions allows businesses to regularly communicate with customers and keep them engaged.

- Proactively Reattempt Payment Failures to Prevent Unnecessary Churn

Issue: Payment failures due to expired cards or insufficient funds can lead to cancellations if not addressed in time.

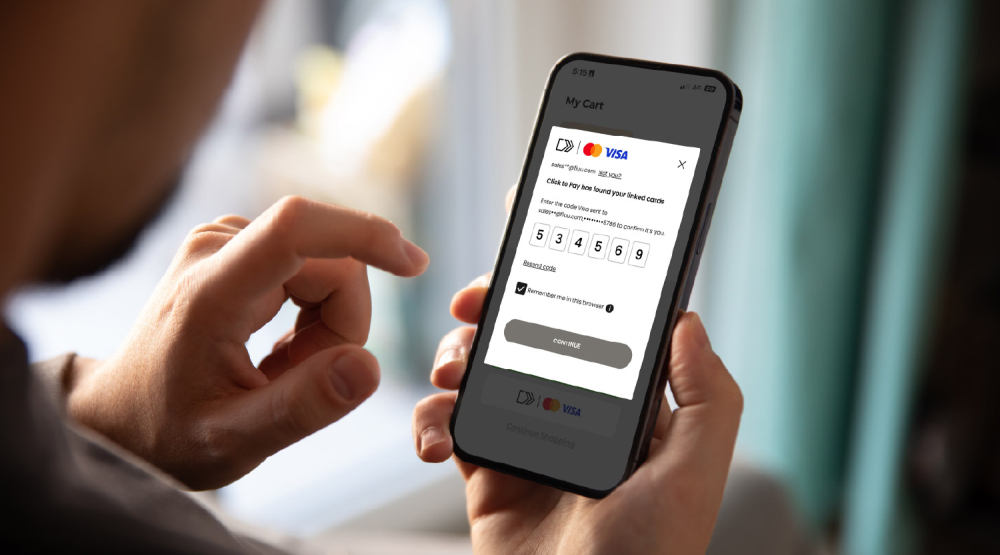

Solution: Fiuu’s recurring payment solution addresses this issue by offering card information update and multiple reattempts features that merchants can set up for each customer. An alternative solution is for merchants to offer a payment link, streamlining the payment process and enabling customers to complete transactions within 5 minutes.

- Simplify Recurring Payments for Seamless Customer Experience

Issue: Research shows that 17% of users abandon subscriptions due to complicated payment systems. Complex payment processes create friction, frustrating customers and increasing the likelihood of them canceling their subscriptions.

Solution: Simplifying the payment process by offering easy-to-use and automated payment methods significantly improves the customer experience. With Fiuu’s recurring payments, your business operations can be simplified, and customer satisfaction can be increased with our reliable solution.

- Leverage Analytics to Optimize Your Recurring Payments Strategy

Issue: Based on Forbes, while 80% of companies believe they provide a superior proposition and only 8% of customers agree. This gap highlights the challenge of understanding customer needs without the right data.

Solution: By leveraging analytics tailored to recurring payments, businesses can monitor payment patterns and identify early signs of churn. Data on payment failures can help businesses optimize their payment strategy whether by adjusting payment schedules or creating more flexible pricing plans.

Fiuu as Your Partner in Reducing Churn

- Increase Customer Retention through Flexibility

By offering flexible payment schedules, it helps meet the varied needs of your customer base. Fiuu’s recurring payments allows you to offer this flexibility, which encourages long-term commitments and reduces cancellations.

- Improve Cash Flow with Predictable Payments

By automating recurring payments, Fiuu ensures that businesses receive timely payments on a regular schedule. This consistency helps businesses manage cash flow efficiently, making it easier to forecast future revenue.

Let Fiuu help you optimize your recurring payment strategy and take your business to new heights.