6 Things to Consider When Choosing the Right Payment Partner in Southeast Asia

November 01, 2021

Running and scaling a business in Southeast Asia can be tricky for several reasons - Your market may have high business demand, or you may spend time securing perfect advertisement placements, but most importantly, your business requires revenue to continue thriving.

With a fragmented payments eco-system across Southeast Asia, businesses resort to multiple payment partners when scaling their business across the region. Read on to find the 6 essential criteria you should know when choosing the right payment partner to scale your business with.

1. Strength & Stability of System Infrastructure

Have you ever stayed up late for a major sale, only to face a frozen checkout page? That’s the nightmare scenario you want to avoid for your customers.

To maintain high sales conversion rates, your payment gateway must excel during peak traffic periods, such as Black Friday or 11.11 sales. A robust system with the capacity to handle heavy transaction loads without downtime is critical. Look for payment partners whose infrastructure guarantees reliability, even when processing thousands of transactions simultaneously.

2. Financial Strength & Reputation of Company

When you choose a payment gateway, you’re trusting them with your revenue. That’s why it’s vital to do due diligence and verify the financial strength of your provider.

A key indicator of a payment gateway’s credibility is its Total Payment Volume (TPV), which represents the total amount of payment transactions processed in a year. A high TPV reflects financial stability and a strong track record in the industry. Additionally, partnering with a provider backed by years of experience or a reputable parent company adds extra assurance.

3. Verify Their Clientele for Reliability

A payment partner’s existing clientele is one of the best indicators of its reliability. If blue-chip companies or well-known brands use their services, it’s a sign that the provider is trusted.

Before signing on, check if the gateway serves clients similar to your business or operates in industries with high transaction volumes. A strong merchant network, especially one that includes household names, can give you confidence that the provider can support your business needs.

4. Technical Support Capacity

The payment landscape is constantly evolving, with new technologies and customer expectations emerging all the time. That’s why your payment partner must have a strong technical support team to ensure minimal downtime.

When issues arise—whether it's technical glitches or surges in transaction volume—you’ll want a team of highly trained specialists who can resolve problems quickly. The ability to provide 24/7 support is essential, especially during critical sales periods.

5. Offer Extensive Payment Method Options

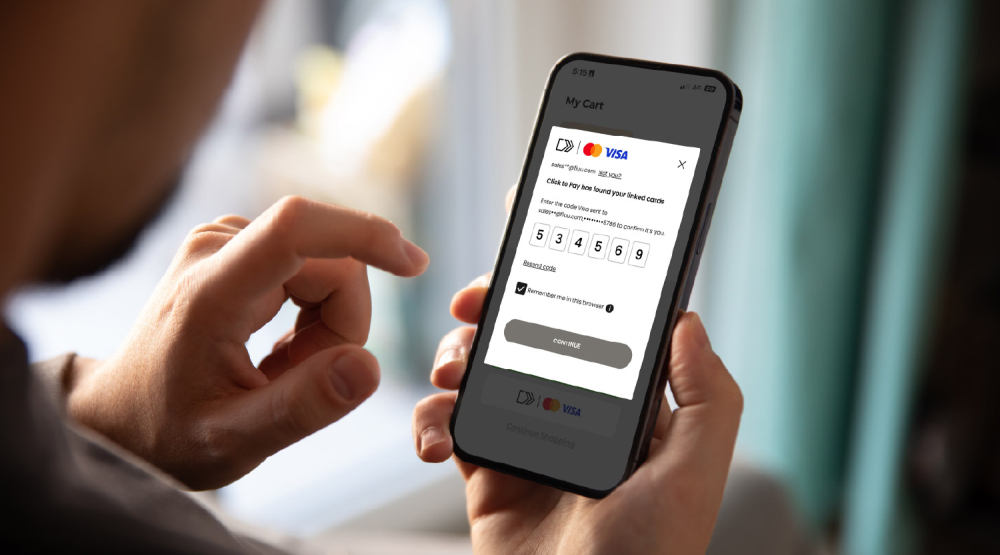

Consumers today are spoiled for choice when it comes to payment methods. From e-wallets to credit cards and online banking, the flexibility to pay with their preferred method is something your customers expect.

To stay competitive, choose a payment gateway that supports a wide variety of payment methods. It should accept major credit cards, local and international e-wallets, and online banking services like FPX. A future-proof provider will also continually update its payment options to align with new trends and technologies in the market.

6. Prioritize Security & Reliability

Trust is essential when handling payments, and security should be a top priority. Ensure your payment partner is verified by the local regulatory body—such as Bank Negara Malaysia—and complies with global data security standards like PCI DSS.

Additionally, look for providers that have a proven track record of reliability. For example, Razer Merchant Services (RMS), a leading payment gateway in Southeast Asia, is backed by 16 years of industry experience and a compliant infrastructure that meets the highest security standards. RMS has one of the lowest dispute transaction ratios and provides high availability during peak sales periods, making it a trusted partner for businesses like Shopee, Google, and Starbucks.

Why Fiuu?

Fiuu is not just a payment gateway—it’s a powerhouse trusted by some of the biggest names in eCommerce. With a total payment volume of over US$4.3 billion in FY2020, Fiuu’s infrastructure can handle more than 100,000 transactions simultaneously without a hitch. Its extensive network across Southeast Asia supports local e-wallets, credit and debit cards, FPX/online banking, and even direct debit options.

Fiuu is also backed by a team of 60 engineers dedicated to ensuring zero downtime and maintaining the system’s integrity, even during high-volume sales periods.

Ready to Scale Your Business?

Looking for a payment partner you can trust with your growing business? Fiuu is the payment gateway of choice for some of Southeast Asia’s largest brands. Get in touch with us today to learn how we can help you scale your business smoothly and securely. Get in touch with Fiuu to power your business with the payment gateway trusted by SEA’s biggest eCommerce companies.