Chargebacks 101: What Are They and How to Prevent Them

February 06, 2026

For any business processing payments online, there is a distinct difference between a lost sale and a chargeback. The latter doesn’t just cost you revenue; it costs you fees, operational time, and potentially brand trust.

According to the Visa 2025 Global eCommerce Payments & Fraud Report, merchants typically have the lower-hand in fraud disputes, with only a 17.1% win rate.

At Fiuu, we’ve spent two decades processing billions in volume across Southeast Asia. We’ve seen firsthand how high chargeback rates can affect a merchant’s cash flow. But what exactly is a chargeback, and why is it different from a standard refund?

What is a Chargeback?

A chargeback is a forced transaction reversal initiated by the cardholder’s issuing bank, not the merchant.

A chargeback differs from a refund, it is a dispute which forcibly withdraws the money from the merchant’s account, while a refund is a service or action initiated by the merchant.

The key difference: Refunds are a customer service, while a chargeback is a bank-level dispute.

Why do Chargebacks Happen?

Chargebacks happen mostly for three main reasons:

- Third-party Fraud: A third-party fraudster who illegitimately obtained the cardholder's details uses it to make unauthorized transactions and purchases, to which the legitimate cardholder files a dispute for.

- First-party (Friendly) Fraud: A legitimate customer makes a purchase or a transaction, then disputes it as unauthorized purchases, with the purpose of getting a free goods or services.

- Merchant Error: Merchant mistakenly charges customers twice for the same purchase or did not deliver the product in accordance with merchant policies.

How to Prevent Chargebacks: 4 Simple Steps

These are 4 simple steps a merchant can take to mitigate chargeback risks and ensure smooth end-to-end payments.

1. Standardized Branding

Problem: One of the most common reasons for “Friendly” Frauds are mere confusion. According to Chargebacks911’s Annual Cardholder Dispute Index, about 58% of cardholders claim that billing descriptions in their statements often are misleading and confused as fraudulent transactions.

Solution: Merchants need to standardize their branding in payment descriptors, ensuring the publicly recognized brand name is presented in the billing description.

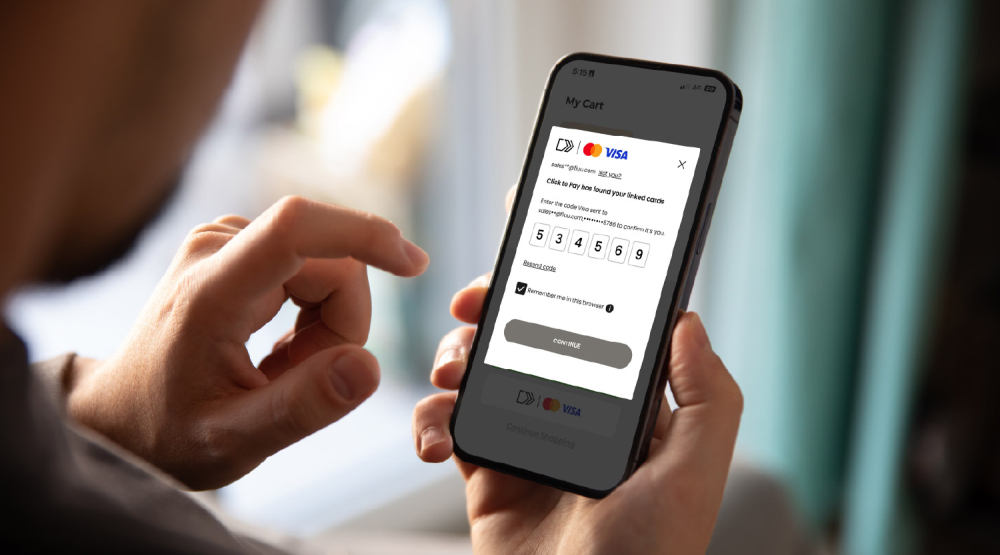

2. Leverage 3D Secure (3DS)

Problem: In a standard Card-Non-Present (CNP) transaction, 3DS serves as an added layer of security with its requirement for identity authentication via OTP or biometrics via the card issuer.

Solution: Enable 3D Secure card transactions for your business with Fiuu. This helps to mitigate main fraud risks and shift fraud-prevention liability to the card issuer, away from your business.

3. Clear Communication and Policies

Problem: Customer files disputes after placing an order due to miscommunication of delivery timelines and expectations.

Solution: Create a detailed delivery, refund and order processing policy page. This documentation helps to protect your business, and communicates the timeline expectations clearly to customers, avoiding vague areas for disputes.

4. Integrate with a Reliable Payment Partner

Problem: Most merchants don’t realize fraudulent transactions until after they happen, and that’s when it’s already too late, incurring operational costs and chargeback fees.

Solution: A reliable payment partner like Fiuu helps to keep your business away from chargebacks and frauds, with modern comprehensive solutions in place to monitor suspicious activities and stop them before they happen. Read more about Fiuu’s Fraud Management Framework here.

Secure Your Bottom Line, Scale Your Business with Fiuu

Partner with Fiuu today for a payment infrastructure that prioritizes security without sacrificing speed. We help you stay ahead of disputes so you can focus on what matters most, your growth and bottom line.

For more enquiries, just email us at [email protected].