Unlocking the Potential of Virtual Terminals for Businesses in Southeast Asia

February 28, 2025

Southeast Asia's digital economy is booming, with e-commerce transactions expected to hit $417 billion by 2028. As online shopping takes off, businesses need flexible payment solutions—enter virtual terminals. These software-based tools let businesses accept payments without physical hardware, making them a game-changer in a region where mobile payments are on the rise.

What is a Virtual Terminal?

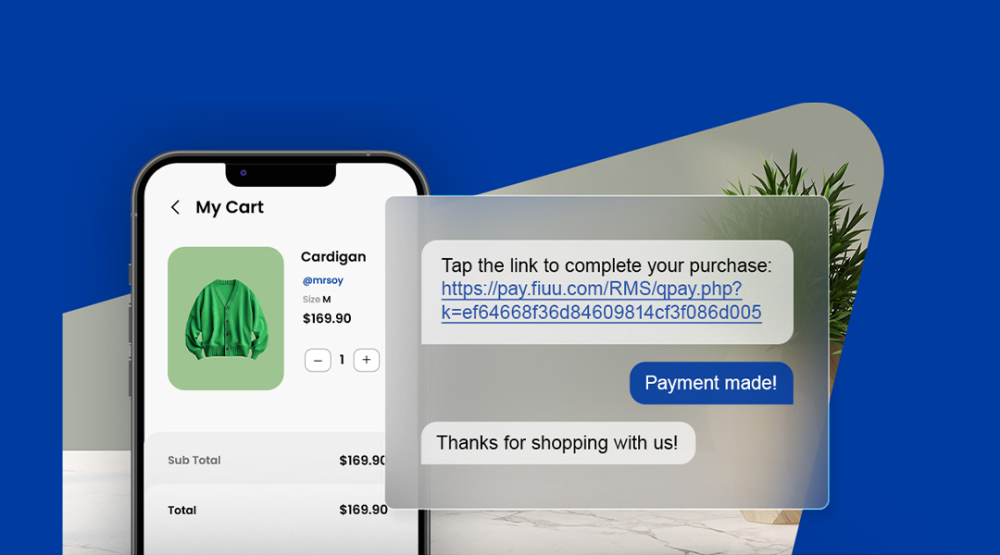

A virtual terminal is a secure, web-based application that allows businesses to process credit card and debit card payments remotely, without the need for a physical point-of-sale (POS) terminal. Typically, virtual terminals are accessed via smartphones or tablets, making them ideal for businesses that operate in the field or for those providing remote services.

3 Big Benefits of Using a Virtual Terminal for Your Business

-

A virtual terminal gives businesses the power to accept payments from anywhere—fast and securely. Whether handling remote sales, phone orders, or payments at events, it offers a simple, scalable solution. No complex setups, just a smooth, hassle-free way to process transactions for both businesses and customers.

-

As your business grows, managing multiple payment systems can become a headache. A virtual terminal provides the scalability and flexibility to seamlessly integrate with your existing payment infrastructure, making it easy to expand into new markets or add services—without the hassle of juggling separate payment platforms.

-

Convenience wins customers. A virtual terminal supports tap-on-card, e-wallets, and online banking—whether customers pay online, over the phone, or via mobile. A streamlined checkout means happier customers and stronger loyalty. A McKinsey & Company report even found that 74% of customers prefer businesses with seamless digital payment options.

| Type of Business | How Virtual Terminal Benefits |

|---|---|

| Healthcare Providers |

|

| Real Estate Agencies |

|

| Retailers with Pop-up Stores |

|

| Subscription-Based Businesses |

|

In addition to various business types, Fiuu’s virtual terminal is designed to support a diverse range of industries. This includes sectors such as restaurants, retail, freelance services, and many more. Its versatile functionality ensures that businesses across different fields can streamline their payment processes efficiently, providing a seamless experience for both merchants and customers alike.

Why Fiuu is the Ideal Virtual Terminal Solution

As businesses continue to digitize, Fiuu's comprehensive payment solutions stand out as a reliable, secure, and scalable choice. Whether you’re a large corporation or a growing SME, Fiuu empowers you to unlock the full potential of virtual terminals and take your payment systems to the next level. Ready to transform your business’s payment experience? Explore how Fiuu can streamline your operations and enhance customer satisfaction by registering at https://booster.fiuu.com/ or email us at [email protected] today!