How Payment Links Simplify SaaS Businesses for Revenue Growth

May 13, 2025

Building and scaling a SaaS startup is hard enough. From product development to user onboarding, every second counts — especially in the early stages.

That’s why more SaaS startups are using payment links — and why they're choosing Fiuu, a leading payment gateway in Southeast Asia, to power those links. Fiuu enables SaaS businesses to create payment links instantly and get paid — with zero coding required.

In this blog, we’ll break down how payment links solve key problems for SaaS businesses and why they’re becoming essential for startups and even enterprise SaaS players.

1. No Developers? No Problem

If you’re a non-technical founder, setting up a full payment system sounds like a nightmare:

- You’d need to hire developers

- Set up APIs

- Integrate with your database

- And constantly maintain the system

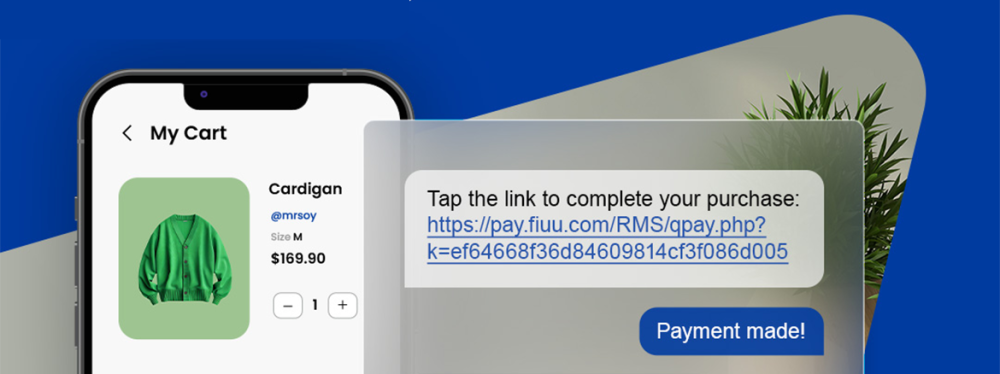

With payment links, you skip all of that. Just create a link via Fiuu’s virtual terminal, send it to your customer and get paid.

According to CBInsights, 38% of startups fail due to cash flow issues. The faster you can get paid, the more likely your startup is to survive and scale.

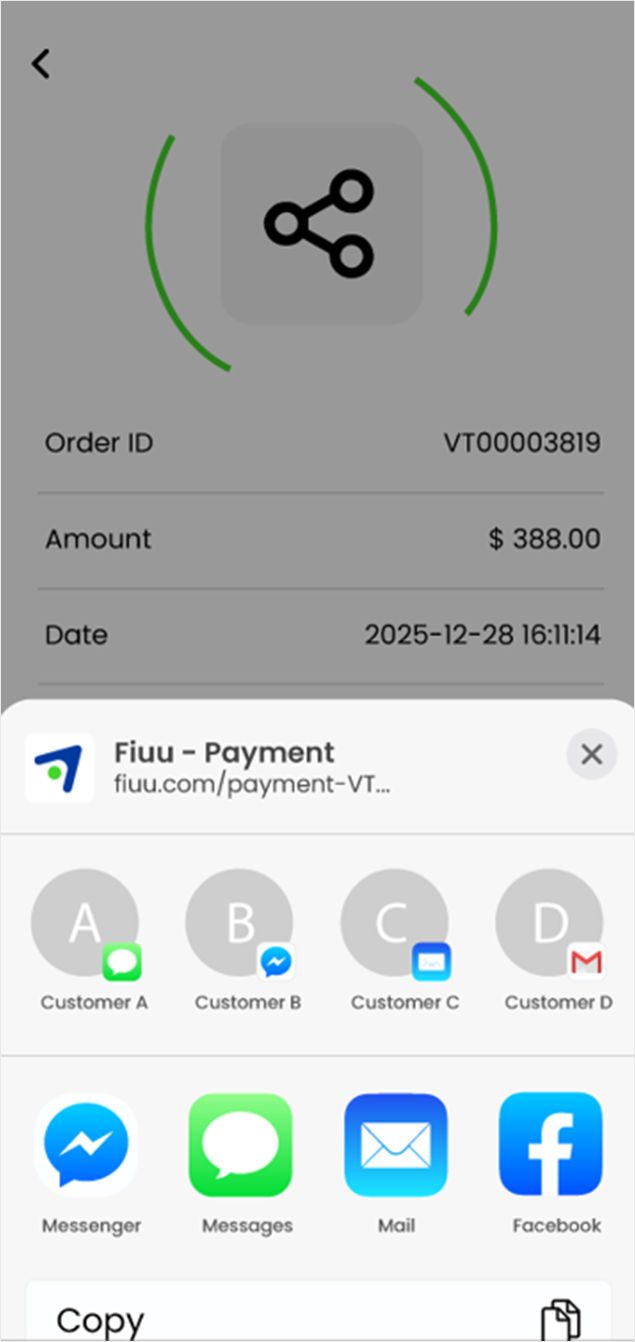

2. Improve Reporting with Trackable Links

One underrated advantage of payment links? They’re trackable. You can assign them to:

- Different sales reps

- Specific products or campaigns

- One-time launches or promo offers

This gives your sales and finance teams real-time visibility on what’s working and where the money’s coming from.

A McKinsey report found that automating payment workflows can reduce finance team workloads by up to 50% — especially when manual invoicing and reconciliation are replaced by trackable links.

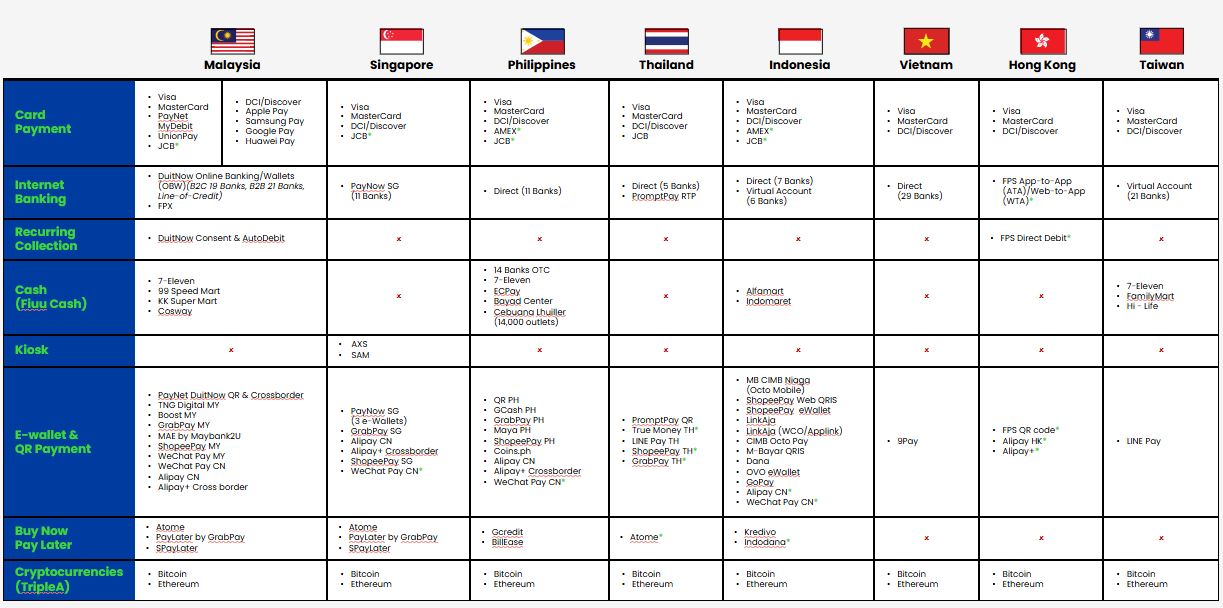

3. Unlock Local and Global Payments with a Link

If you’re a SaaS company expanding in Southeast Asia, supporting local payment methods is no longer optional – it’s essential. Fiuu’s payment links let you accept a wide range of payment channels, as shown in the visual below:

A Business Wire report showed that 76% of Asia-Pacific consumers prefer local payment methods for e-commerce transactions. Without these options, you risk losing up to 3 out of 4 potential customers — even if your product is perfect.

4. Sell Subscriptions, One-Off Products or Trials Flexibly

Most SaaS businesses need to support a mix of pricing models:

- Monthly or yearly subscriptions

- Free trails that convert into paid plans

- One-time purchases like onboarding, consulting or upgrades

Payment links can handle all of these, depending on how you configure them

According to Recurly's data, implementing payment links can boost revenue from subscription products by up to 119%, underscoring the value of streamlining the payment process.

5. Simplify the Payment Experience = More Conversions

Complex checkout processes cause friction – and friction kills revenue. Most checkout pages ask for logins, card details, and way too many clicks. Fiuu’s payment link, on the other hand, brings customers straight to a clean, secure payment page.

According to the Baymard Institute, 69.8% of online shoppers abandon their cart — and one of the top reasons is “too long/complicated checkout.” By sending a simple link (via email, WhatsApp, or social), you eliminate friction and get paid faster.

Why Fiuu is the Right Payment Partner for SaaS

If you’re ready to scale your SaaS startup across Southeast Asia – and beyond – Fiuu makes it easy. Here’s how Fiuu supports your payment needs:

- No-code payment link creation

- Accepts all major local payments channels in Southeast Asia

- PCI-DSS certified

- Real-time dashboard for finance and sales teams

Ready to start accepting payments the smart way? Let Fiuu help you accept payments in minutes – without the dev work. Talk to our team today at [email protected] or register at https://booster.fiuu.com/ and launch your first payment link in minutes.