How Hosted Payment Pages Simplify the Payment Process across Southeast Asia

June 19, 2025

By 2028, digital payments are expected to account for 94% of total e-commerce payments in Southeast Asia. This growth will be largely driven by mobile wallets and domestic payment methods, which have expanded the reach of e-commerce in areas that traditionally relied less on card payments. Hosted Payment Pages are emerging as the go-to solution to help businesses streamline payment flows without the complexity of managing sensitive customer data themselves.

This blog will explore how HPPs can ease payment challenges for businesses in Southeast Asia, and more specifically, why Fiuu offers the best Hosted Payment Pages solution for companies aiming to scale efficiently.

What is a Hosted Payment Page?

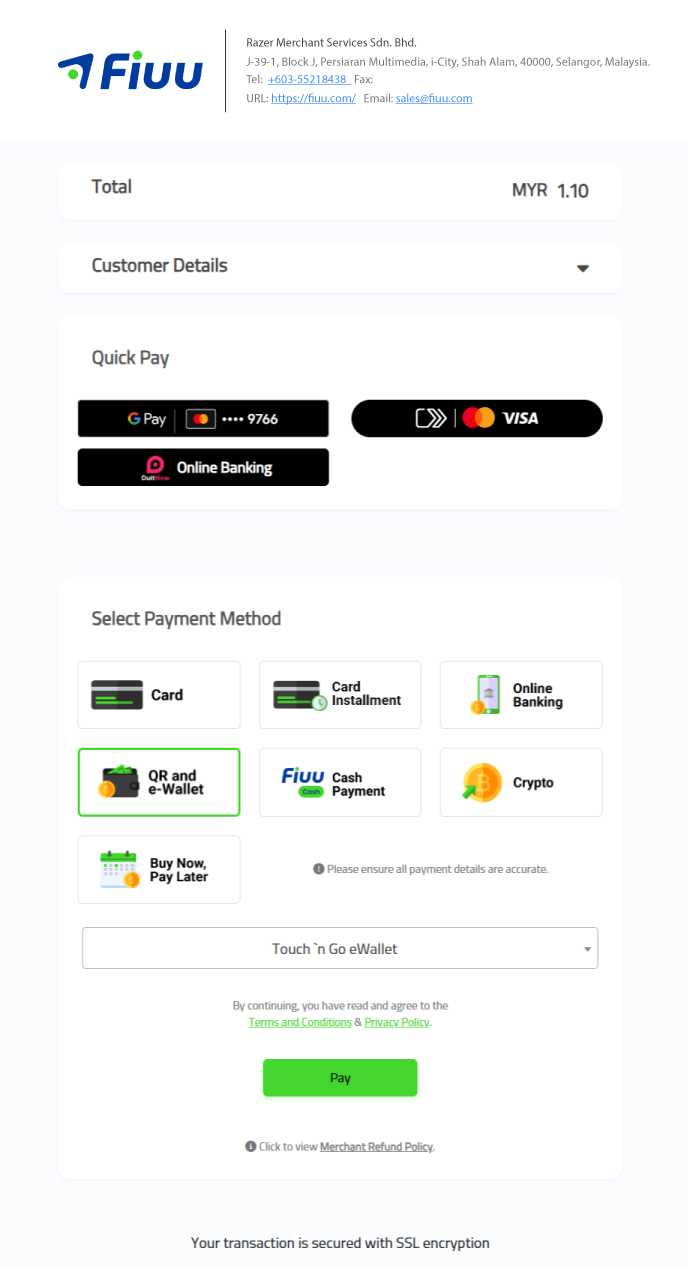

A Hosted Payment Page (HPP) is a secure, externally managed solution for processing payments, where the entire transaction flow is handled by a third-party provider. When using an HPP, the customer is redirected to a secure page hosted by the payment gateway, ensuring all sensitive payment data is processed safely off-site, and then returned to the merchant’s website once the transaction is complete.

Fiuu’s Payment Page

3 Key Advantages of Hosted Payment Page

1. Streamlining Cross-Border Payments

Southeast Asia is dynamic region, consisting of multiple countries, each with its own currency and payment preferences. With HPPs, businesses can effortlessly accept a wide range of local currencies, including SGD, MYR, IDR, and PHP, along with various payment options, such as credit and debit cards, as well as regional payment solutions like Alipay, GrabPay, and PayNow.

Data Insight: According to the World Bank Group, the average remittance cost for cross-border payments in Southeast Asia is about 6.3%, making it more expensive than many other global regions. By using HPPs, businesses can reduce these costs by offering localized payment options and improving efficiency.

2. Effortless Integration with Existing Systems

As businesses grow and expand, connecting payment solutions to their existing technology stack becomes essential. HPPs provide businesses with a simple, hassle-free way to integrate payment systems into their existing infrastructure.

Data Insight: A Forrester Consulting study on Sage Intacct found that integrating financial systems led to increased productivity and revenue capture, delivering $81.3 million in benefits over three years for a composite financial services company. The ability to automate payment processes and sync them with other business functions is essential for sustainable growth.

3. Seamless Mobile Optimized Payments

Southeast Asia is one of the most mobile-centric regions in the world, with more than 70% of internet users accessing the web via smartphones. HPPs allow businesses to create a payment process that’s not only secure but also mobile-optimized, offering customers a fast and seamless checkout experience on their smartphones.

Data Insight: According to a report by Google, Temasek, and Bain & Company, mobile internet penetration in Southeast Asia is significant, with more than 40% of the region's e-commerce sales taking place on mobile devices. This trend is expected to continue growing, making it vital for businesses to prioritize mobile-first solutions.

Types of Hosted Payment Page

There are several distinct types of HPPs, each designed to provide varying levels of integration and customization based on the specific requirements of a transaction process. Below we outline three types of HPP, each offering unique features:

| Types of Hosted Payment Page | Description | Example |

| Standard Hosted | A simple payment page hosted by the payment gateway, where customers are redirected to complete the transaction. | A customer is redirected to a secure payment page where they enter payment details and complete their purchase. |

| Iframe Embedded Payment Page | The payment form is embedded directly within the merchant's website, allowing customers to stay on the same page while securely entering payment information. | A customer sees the payment form within the checkout page of the merchant’s website, completing the payment without leaving the site. |

| One-Click Payment Page | A payment system that allows returning customers to complete purchases with a single click, using pre-saved payment information for faster checkout. | A repeat customer can complete their purchase with a single click, using stored payment details to speed up the checkout process. |

Why Fiuu is the Right Partner for Your Business

Hosted Payment Pages are revolutionizing how businesses process payments, offering clear advantages in terms of efficiency, security, and scalability. Whether you are a small startup or an established enterprise, Fiuu offers a comprehensive payment solution that grows with you in Southeast Asia. With Fiuu, your business can offer customers a fast, secure, and scalable payment experience, helping you stand out in the competitive Southeast Asian market

Ready to take the next step in streamlining your payment processes? Contact Fiuu today at [email protected] or register at https://booster.fiuu.com/ and discover how Fiuu can help your business grow!